Participants both inside and outside of the nuclear fuel industry have continued to seek more frequent and reliable nuclear fuel price indicators.

Historically, the industry operated with spot U3O8 prices that were published once a month.

In 1987, Ux introduced the weekly Ux U3O8 Price®, the first, and only, weekly price for almost 10 years.

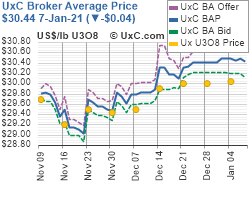

In September 2009, UxC launched its daily UxC Broker Average Price (UxC BAP®) reporting as

part of it services to subscribers.

Additional details of this price launch was provided in the cover story of the September 7, 2009 issue of the Ux Weekly.

In September 2021, UxC transitioned to reporting the UxC Broker Average (BA) Bid and Offer.

Under cooperation with our participating brokers, Evolution Markets and Numerco Limited Limited (the “Brokers”),

UxC collects on a daily basis the best spot bids and offers reported for up to a three-month forward period.

From this Broker data, UxC calculates the UxC BA Bid and the UxC BA Offer prices and presents them in the Ux Weekly for comparison purposes only.

UxC Participating Brokers

Since 2004, a number of commodity style brokers have been active in the nuclear fuel sphere in order to expand their energy product offerings.

Two of the brokers have joined with UxC as Participating Brokers in providing data for UxC’s Broker Average (BA) Prices.

Additional information on these companies can be found on their respective websites.

Evolution Markets

Evolution Markets

Numerco Limited

Numerco Limited